文|人大重阳

作者罗思义(John Ross)系英国伦敦前经济与商业政策署署长、中国人民大学重阳金融研究院高级研究员。本文刊于7月31日新浪网,英文刊于8月1日中国网英文版。原标题为“美国经济仍将缓慢增长”。

7月28日,美国商务部经济分析局(BEA)发布了美国2017年第二季度GDP数据。要检验美国经济形势分析正确与否,就有必要运用实事求是的方法。因此,下文将首先分析美国最新经济数据,然后论述由此产生的结论。值得一提的是,美国最新经济数据有力地印证了拙文《美国对外政策屡屡受挫,章家敦们功不可没》中所作的分析。

2017年第二季度美国GDP同比增长2.1%

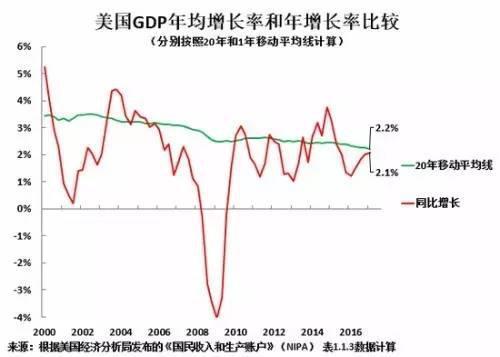

2017年第二季度美国GDP同比增长2.1%,较今年第一季度同比增速(2.0%,修正值)略有上升。如图1所示,同期中国GDP同比增长6.9%。也即是说,今年第二季度中国GDP增速是美国的逾3倍。

有必要指出的是,BEA公布的GDP数据是“年化季率”,而非“同比增长率”。而“同比增长率”相较“年化季率”更为可靠,也更能准确反映美国经济表现。众所周知,美国每年第一季度GDP数据即使经过季节性调整也是不准确的,因为其低估了美国GDP增速。尽管美国统计部门也意识到这个问题,但迄今没有成功地解决这一问题。

从2015年第二季度至2017年第二季度,中国GDP同比增速从7.0%降至6.9%,美国GDP同比增速则从3.8%降至2.1%。这说明,彭博社和其他部分西方媒体前段时间所宣称的“美国经济正强劲复苏,中国经济面临硬着陆的风险”的说法,与事实完全相反。中国经济增速不仅是美国的逾3倍,而且中国增速仅略微放缓,美国则是显著放缓。

但在美国缓慢增长、中国增速相较美国快得多的总体框架下,有必要指出,与2016年第二季度的低迷表现(1.2%的同比增速)相比,今年美国经济出现一定程度的复苏。

图一

美国短期与中长期趋势比较

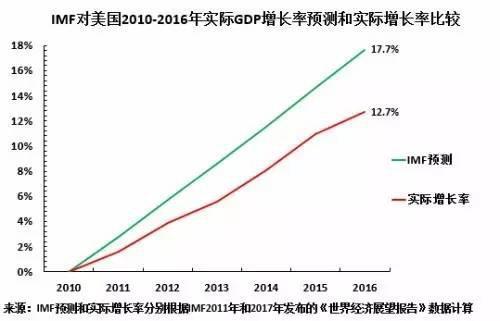

但要评估美国最新经济数据的重要性,就应记住:市场经济具有经济周期。因此,为避免高估或低估增长,就有必要将长期趋势与短期趋势划分开来。周期性波动会导致短期平均增长率高于或低于长期平均增长率,运用长期移动平均线则可消除这种周期性影响。因此,图2为大家呈现分别按照20年移动平均线和同比增长计算的美国GDP年均增长率(2.2%)和年增长率(2.1%)比较。按照5年移动平均线计算的结果,与美国GDP年增长率极为相似。总的来说,美国长期平均增长率略高于2%。

如图2所示,美国2016年增长率显著低于其长期平均增长率,这说明美国正经历周期性下降。由于周期性原因,预计2017年美国经济增速会出现微弱回升,或者快于其长期平均增长率,弥补2016年低迷增长的影响。

与2016年的低迷表现相比,2017年美国第二季度增速略有加速显示,这样的趋势是正常的周期性反应,而非美国长期增长加速的迹象。特朗普总统可能会称美国经济出现一定程度的复苏归功于自己。但事实上,这只是出于统计效应,而非实质性加速。

概括来说,美国2017年增速将较2016年的低迷水平,出现一定程度的复苏。但并不意味着美国长期增长率会出现加速,预计美国长期平均增长率将略高于2%。

图二

比较三种势力对美国经济增长的预测

本节检验三种势力对美国经济形势的分析是否违背事实。这具有重大的现实意义,因为准确分析美国经济对中国经济与地缘政治均非常重要。但直到最近,包括中国某些圈子在内的三种势力对美国经济形势的过高分析,被证明是错误的。

正如上文所述,部分西方媒体报道称“美国经济正强劲复苏”。但事实上数据显示,这样的情况并没有发生。即这样的媒体如此报道是出于宣传目的,而非分析事实。

正如下文分析所示,西方主要机构,特别是国际货币基金组织(IMF),犯的系统性错误是在预测时过高估计美国增长率。

中国的买办知识分子最习惯说的一句话,就是“中国或成最大输家”。

这三种因素中的第一项已被证明是错误的,这里就不再赘述。至于第三项,相信除了中国某些圈子将这样的说法视为金科玉律外,中国绝大部分公众都只会一笑置之,因此对此也不再赘述。下文将重点论述第二项——IMF的错误分析。

为何长期以来IMF对美国经济增长的预测总是过于乐观?

事实显示,长期以来,IMF对美国经济增长的预测过于乐观。换言之,IMF对于美国经济增长存在乐观倾向。

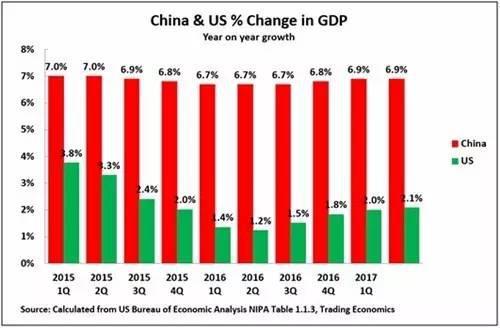

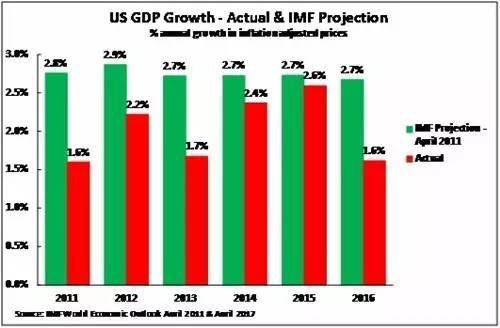

IMF通常每年发布两次对各国未来5年增长的预测。为便于大家了解这些预测与实际增长率之间的区别,图3为大家呈现IMF对2011-2016年美国经济增长的预测和实际增长率比较。可以看出,IMF预测的美国GDP年增长率高于其实际增长率,有时高估美国GDP年增长率高达1.2%。

图三

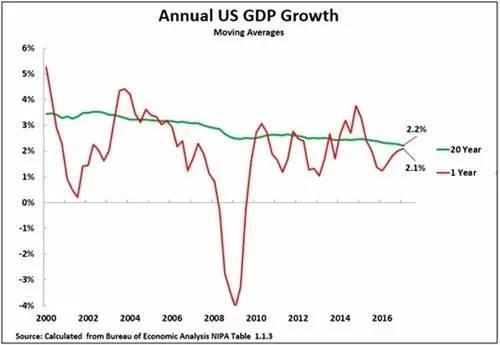

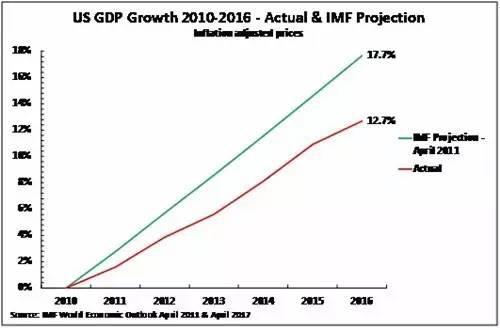

图4呈现的是IMF对美国预测过于乐观的累积结果。IMF预测,2010-2016年美国经济将增长17.7%,,但其实际增长12.7%,即IMF高估美国这一段段增长率5%。按照当前美元汇率计算,2016年美国GDP增长总量约为9200亿美元,接近一万亿美元,少于IMF的预测。

图四

虽然至少有些错误是不可避免的,但在精心构建的经济模型中,错误应具有随意性,即增长预测应有时高于或低于实际增长率。但如果对某国的增长预测总是高于实际增长率,那么模型就存在系统性偏见。也就是说,IMF模型偏向于系统性地夸大美国经济增长前景。

平心而论,IMF近来已通过下调美国经济增长预期,纠正了其预测。IMF在最新发布的《世界经济展望报告》中预测,2016-2022年美国GDP将年均增长2.0%,这大致吻合美国当前经济形势。但长期以来,IMF对美国经济增长的预测过于乐观,是不可接受的。这违背了实事求是的原则。中国某些圈子,包括大学和研究机构,也犯的一个严重错误,是在没有核实IMF预测是否吻合实际数据的情况下,就全盘接受这样的预测。

结论:中国某些圈子应停止盲目迷信IMF等西方主要机构,学会客观评估美国增长前景

因为准确评估美国经济发展趋势对中国非常重要,所以笔者将相当多的注意力放在纠正中国某些圈子夸大美国增长前景方面。美国的实际经济形势如下:

2017年美国经济会出现周期性的微弱回升;

这种微弱回升不足以改变美国中长期缓慢增长的主要趋势——美国长期经济增长率将保持在2%左右。

拙著《一盘大棋?——中国新命运解析》,以及拙文《美国经济为何会陷入缓慢增长模式?》,分别从经济理论角度和实证研究角度,对这些趋势形成的原因和决定美国增长的最重要因素,进行了详细分析。美国最新经济数据,显然与我所做的这些分析相吻合。

因此,我深切期望,美国最新经济数据将令中国某些圈子纠正其对美国经济增长的过高估计,学会运用实事求是的原则准确评估美国经济发展形势。

China`s economy growing three times as fast as US

Recent publication of U.S。 GDP figures for the 2nd quarter means data is now available for comparison of China and America, the two largest economies, for the first half of this year。

A systematic comparison of the two economies` performance shows that China`s economy is growing more than three times as fast as the U.S`s。 Because, as will be shown below, China`s growth has not decelerated significantly, the main issue to clarify in comparing Chinese and American growth is trends in the latter。

This article, therefore, analyzes the new U.S。 factual data, errors made by Western media and economic institutions in analysis of the U.S。 economy。

The U.S。 GDP growth in the 2nd quarter was 2.1 percent – a very slight increase from 2.0 percent in the 1st quarter。 Figure 1 compares this to China`s 6.9 percent growth in the same period。

Making a comparison of the latest data to the beginning of 2015, it may be seen that China`s economy slowed very marginally (7.0 percent to 6.9 percent), while the U.S。 economy slowed significantly (3.8 percent to 2.1 percent)。 Therefore, the claim by Bloomberg and other sections of the Western media that lately the U.S。 was undergoing “strong recovery” while China faced the threat of a “hard landing” are the reverse of the truth。

Not only was China growing more than three times as fast as the U.S。 but China`s economy scarcely slowed while the U.S。 decelerated substantially。

Figure 1

Situation of the U.S。 business cycle

To assess the significance of the latest American data, it is necessary to bear in mind that market economies are inherently cyclical。 It is therefore necessary, to avoid exaggerating or underestimating growth, to separate long-term trends from purely short-term cyclical fluctuations。

This may be done by taking a sufficiently long-term average that smooths out business cycle fluctuations – the economy will then be seen to show cyclical fluctuations above and below this long-term average。 Figure 2 therefore shows the latest U.S。 GDP increase of 2.1 percent compared to its 20-year moving annual average of 2.2 percent。 A five-year moving average shows an extremely similar annual average 2.1 percent growth。

Compared to this long-term average growth, Figure 2 shows that, in 2016, the figure was significantly below its long-term average, indicating a cyclical downturn。 In 2017, purely for business cycle reasons, it would be expected that the U.S。 economy would grow at or faster than its long-term average in order to compensate for very slow growth in 2016。

The slight speeding up of the U.S。 economy in the 2nd quarter of 2017, compared to the depressed level in 2016, shows this trend as a normal cyclical movement and not an indication of acceleration of the fundamental American growth rate。 President Donald Trump may want to claim credit for some economic recovery, but it`s a purely statistical process and not a serious acceleration。

To summarize, the latest U.S。 data shows a normal process of recovery from very depressed growth levels in 2016, but no acceleration from a U.S。 basic long term growth rate of at or slightly above 2 percent。

Figure 2

Comparison to predictions

Turning to the test of analysis of the U.S。 economy against these facts, it is easy to factually establish that, over a prolonged period, the IMF made systematically over-optimistic projections for the U.S。 economy – in technical terms the IMF had an “optimism bias” regarding the U.S。 economy。

Twice each year, the IMF publishes five-year projections for countries。 To compare these forecasts to actual growth, the latest available annual growth data for the U.S。 is for 2016。 Figure 3 therefore shows the projections made by the IMF in April 2011 – the earliest year in which it made a forecast for 2016 – compared to actual U.S。 growth。

It may be seen that, for every single year, the IMF predicted higher American growth than actually occurred – the annual exaggeration being up to 1.2 percent。

Figure 3

Figure 4 shows the cumulative result of these over-optimistic IMF projections。 The IMF projected that in 2010-2016 the U.S。 economy would grow by 17.7 percent, whereas actual growth was 12.7 percent。 Put in current prices, the U.S。 economy in 2016 was $920 billion smaller than the IMF projection。

Figure 4

While at least some errors are inevitable, in a well-constructed economic model errors should be random – that is, projected growth should be sometimes above the actual rate and sometimes below。 However, if the differences between projection and reality are always in the same direction there is a systematic bias in the model。

To be fair, it should be stated that the IMF has recently corrected its estimates by sharply revising downwards projections for U.S。 growth。 In its latest World Economic Outlook, it projects annual average U.S。 growth at 2.0 percent from 2016-2022, approximately in line with current factual trends。 However, it`s unacceptable that it got it wrong for so long。

Conclusion

The actual situation of the U.S。 economy and its comparison with China therefore is:

-

There will be a real but relatively limited upturn in the U.S。 business cycle in 2017。

-

This increase will not be large enough to alter the fundamental trend of slow U.S。 medium/long-term growth – which will remain at approximately 2 percent or slightly above。

-

China`s economy is continuing to grow more than three times as fast as the U.S`s。

-

In recent times, it was the U.S。 economy that slowed significantly, not China`s, despite what Western media say。

(欢迎关注人大重阳新浪微博:@人大重阳,微信公众号:rdcy2013)

本文由知事 转码显示查看原文